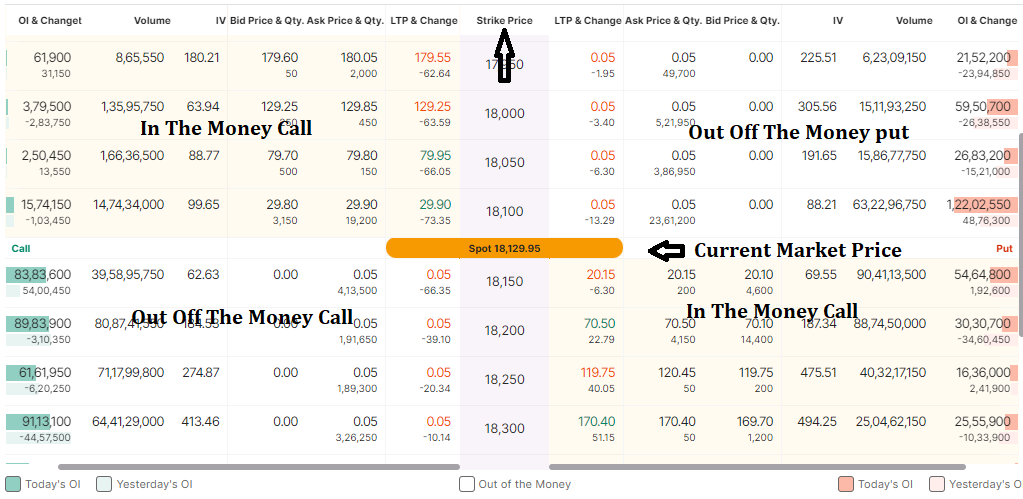

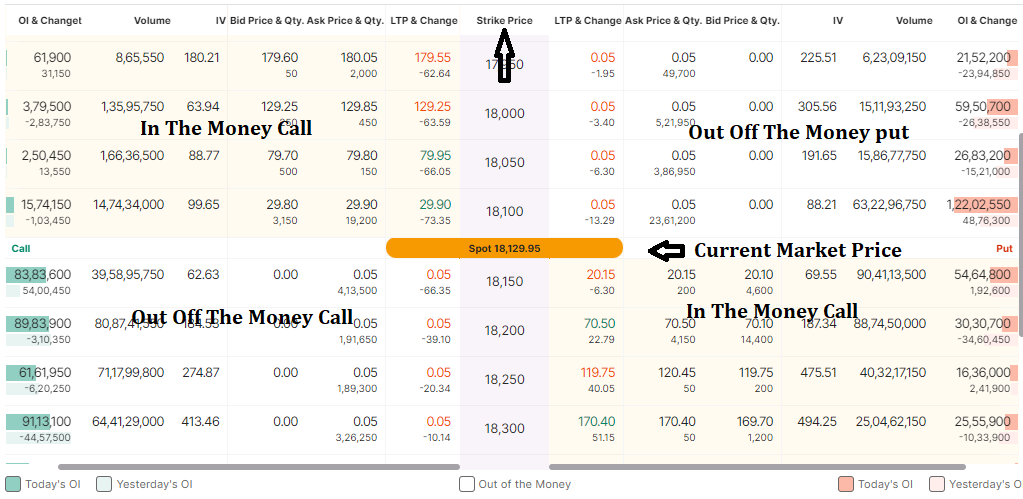

Basic Terms In Options

On Expiry Day

On Expiry day you have to buy Equity Stock Options Not Nifty Options

Its Better to exit on expiry than keep Holding

Futures are financial contracts that obligate the buyer to purchase an underlying asset or the seller to sell an underlying asset at a predetermined price and specified future date.

Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price within a predetermined time period.